Leveraging is one of the most powerful factors which can increase the rewards. However, it also increases the risk. This can be called margin trading. Margin allows traders to open a position with a broker employing a small amount of deposit for taking a much larger position in the market. If a Singaporean trader invest $2,000, he can leverage the trading position up to 200 times or more than that. So if the person leveraged at 200 to 1, it would be uncovering to control a position of $200,000 in the market. When trading on the margin, it is generally shown as a percentage of the total position volume. Such as, Forex brokers will express they require 2 per cent, 1.5 per cent or 0.5 per cent, which enables investors to quantify the maximum leverage they will be exposing themselves to when executing a trade. So if the person puts up $2,000 and decides to unfold a leveraged position, he must be careful about the risk management factors. Keep reading to understand the core concept of leverage trading environment.

It has become an excessively attractive option for investors provided that it permits them to fast track their possible rewards. Woefully, it is the individuals with small deposits and knowledge who are fascinated by these highly leveraged fields as they believe they will become much richer in a short time than from any other approach of trading. But, it is crucial to recognize that if an investor wants to get success in trading over the longer term, that the number one rule in any market is the higher the risk, the greater the level of cognition and experience needed to control the risk. So, let’s learn about the advantage and disadvantages of the approach for leverage trading environment.

Table of Contents

The Advantages of leverage trading environment

One of the advantages of this approach is that it allows the investors with entrance to additional funds because they are taking money from the broker to acquire more exposure to the field than they otherwise would. As people uncover a bigger position in the Forex field, they have the option to boost their returns. Such as the person decides to open a Forex currency trade on the EUR/USD dollar as they believe the value of EUR will decreases in value in opposition to the US dollar. If he decides to trade $1,000 on the margin at 0.5 per cent, his exposure in the field would be $200,000. So, a trader is now managing a $200,000 trade utilizing only $1,000 of their own capital.

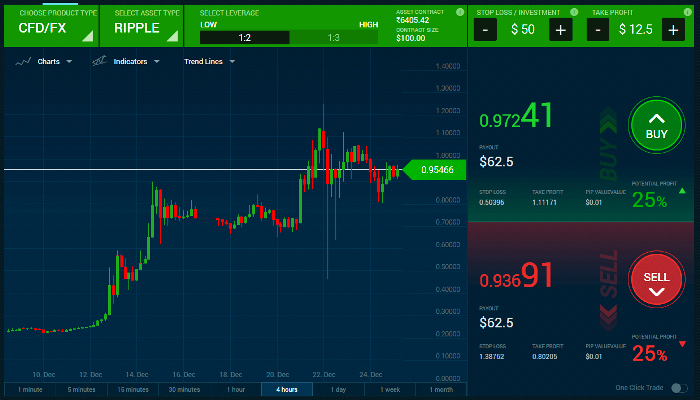

Now, if traders were right in their prediction about the EUR decreasing, so their $200,000 is now worth $202,000. Consequently, if people decide to close the position, they will have made $4,000 on an investment plying $1,000 of their own principle. In simple terms, we can say, it is better to trade with 1:10 or a maximum of 1:50 leverage. Anything above that level imposes a great risk on your career. Visit https://www.home.saxo/en-sg/products/etf and learn more about the optimum leverage for dealing with the ETF industry.

The Disadvantage of Leverage Trading

There are pitfalls to this approach. For example, if the value of the EUR increases in opposition to the US dollar an investor now finds that their current position is sitting at a loss of $2,000 on their beginning exposure of $200,000. This means they are down 400 per cent. So, the person not only lost an initial deposit of $1,000 but they are now needed to pay up an additional $1,500, as the broker will have made a margin call on their account to recover the losses. Actually, Forex brokers will call them to keep a specific amount in their brokerage account to enfold margin calls in the event a trade moves against them. An investor is also required to be aware that when he opens a Forex or CFD account, they will be asked to sign documents that state the negotiator has the right to cover any losses for him if he exceeds the amount of money in his account.

Comments are closed for this post.